what happens if my bank returned my tax refund

In the event that your bank decides not to accept the deposit of your tax refund for whatever reason the monies will be sent back to the Bureau of the Fiscal Service. IRS return and account problems Why you received IRS Notice CP31 You filed a tax return with the IRS which resulted in a refund.

If the account is closed the bank.

. John S Masterson Retired Major Medical Service Corps. Giving the wrong account number may have caused the IRS to deposit your refund into the. In a week or two.

The refund check the IRS. Your bank should return it back to the US Treasury IRS They will then cut a paper check to your address of record. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would.

The Irs updated my wheres my refund on the 27th monday saying it was returned and will be mailed by mar 6 and if not recieved by apr 3 to call back. Call the IRS Identity Protection Specialized Unit at 800-908-4490 right away so that they can begin the process of verifying your information. If the return hasnt already posted to our system you can ask us to stop the direct deposit.

If you cant update your mailing address online. For security reasons we cannot modify the routing number account number or the type of account from what was entered when you filed your return. Do you have to report interest on checking account.

Call or visit your bank if you gave the IRS an account number containing inaccurate digits. Report the Fraud Quickly. Yes interest income that is not specifically tax-exempt would be taxable on your return.

If the third party bank is unable to deposit to the account provided they will either mail you a check or return the refund to the IRS. Most common tax problem area. On the 6 monday it was.

You may call us toll-free at 800-829-1040 M - F 7 am. This includes interest on checking. When that bank refuses the direct deposit where it goes back to depends on where it was from.

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Where S My State Tax Refund Updated For 2022 Smartasset

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

Free Online Tax Filing E File Tax Prep H R Block

Do I Need To File A Tax Return Forbes Advisor

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

No Tax Refund Yet Why Your Irs Money Might Be Late Cnet

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

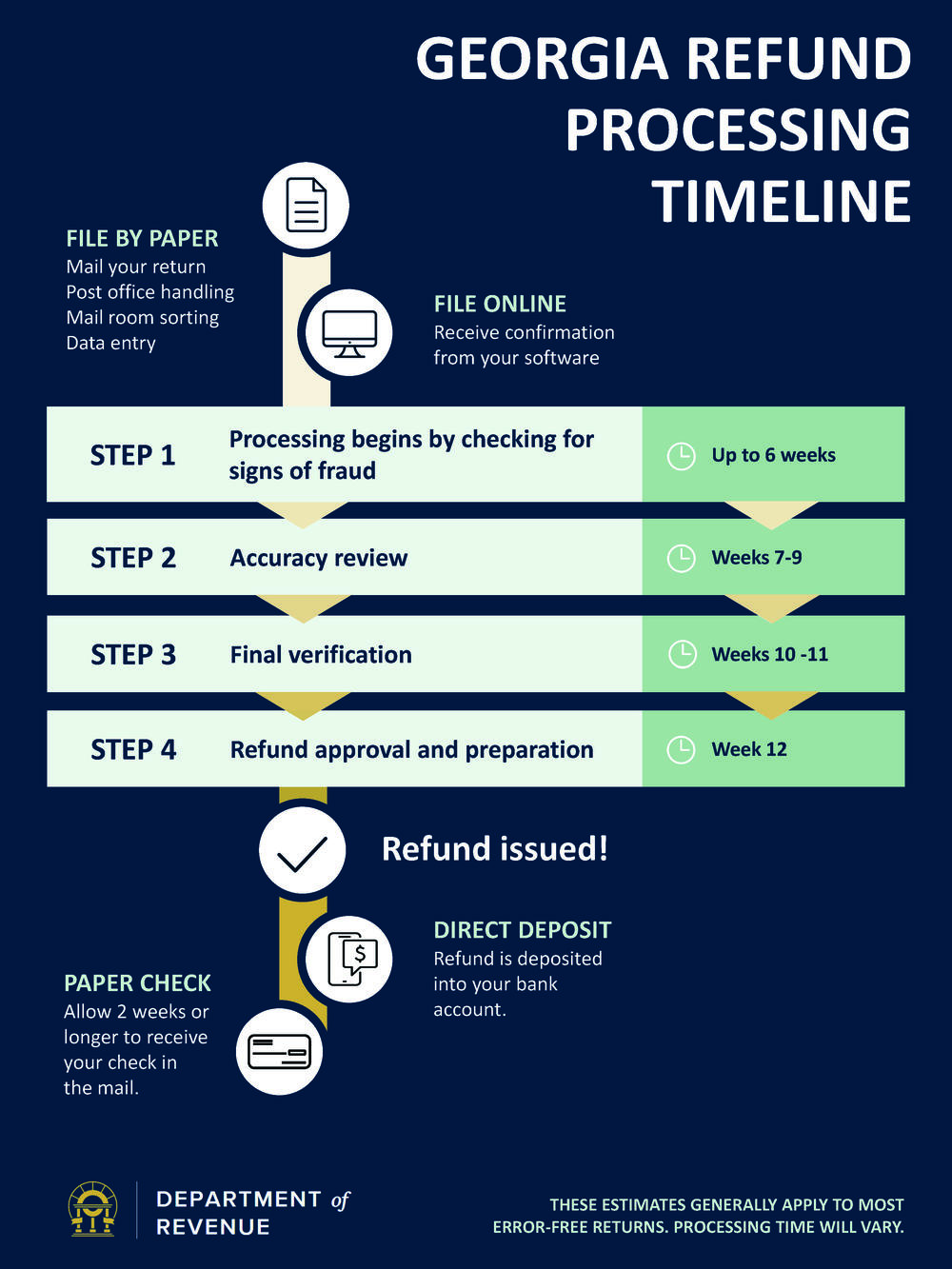

Where S My Refund Georgia Department Of Revenue

How Long Does It Take To Get A Tax Refund Smartasset

Quickest I Have Ever Got My Tax Return Filed 1 19 Recieved 1 20 Approved 1 26 And Refund Expected 1 28 R Irs

My Stimulus Check Went To The Wrong Bank Account Now What The Motley Fool

Set Up Direct Deposit With The Irs When You File Today Here S Why Cnet

Turbotax Where S My Refund Check E File Status Get Your Tax Return Status

Bank Returned My Refund On The Date It Was Supposed To Come Filed On 8 4 Refund Was Returned On 9 2 Why Did My Dates Change On My Transcript R Irs

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

What Happens If Your Bank Rejected Tax Refund Mybanktracker

How To Check Your Tax Refund Status Turbotax Tax Tips Videos